21h ago

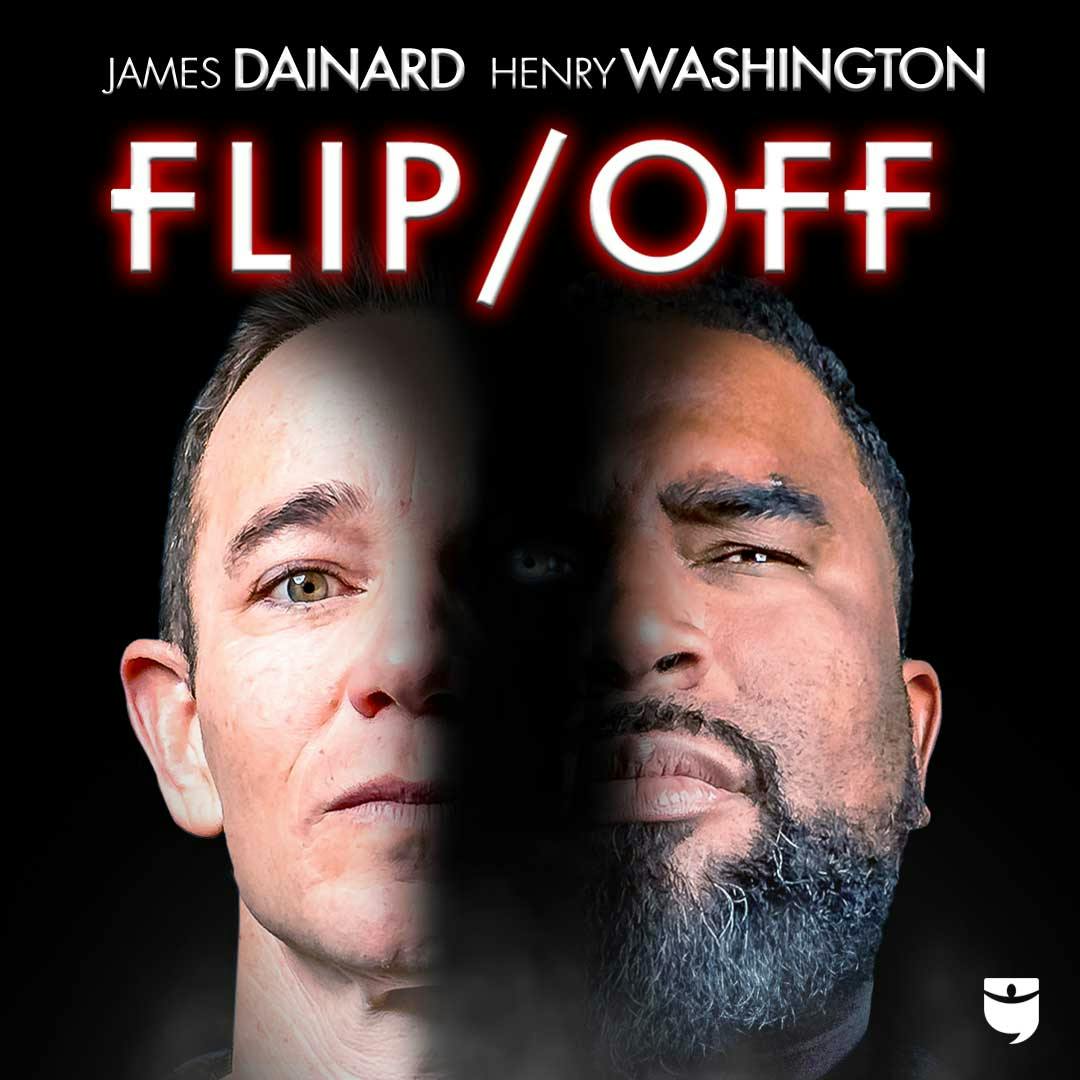

Bold 2026 Predictions: A New "Land Rush" and the Real Recession Hits

Is this the year the real recession finally hits ? Could a new “land rush” spark a buying spree throughout the U.S. for coveted dirt that makes investors millions? And why is one type of rental property owner about to sell off their homes , ready to give you a sizable discount ? We’re still in the swing of prediction season, so this time, we’re giving you our boldest 2026 housing market predictions yet. We’re not talking mortgage rate predictions or home price predictions (we’ve already done that). This time, we’re sharing which real estate could take off or break down —and which could make savvy investors rich, if they’re able to buy the right deals. Some opportunities (like one we’re sharing today) only happen once in a decade , and we’re already getting the jump on them. Henry shares his insider secrets , noting that one specific type of rental is starting to hit the market as once-optimistic owners give up, opting to sell their properties without making a profit. This could be a huge opportunity to pick up homes in great shape and in solid markets at a discount. Dave talks about why this may be the year we finally get a recession and offers some cautious words of wisdom to everyone out there, as “chaos” might be in store . In This Episode We Cover A new land rush? The “opportunity” that is making investors buy the best-located dirt they can Airbnb owners give up : why your next rental property might be a failed short-term rental The “common person’s recession” that will have a massive impact on the economy New “ Big Beautiful Bill ” changes that could make some investors very rich The best year for new investors? Why 2026 could be the easiest time in years to invest in rental properties And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area On the Market 372 - New Recession Indicator Shows Americans Worse Off Than We Thought Dave's BiggerPockets Profile Henry's BiggerPockets Profile Kathy's BiggerPockets Profile Grab Dave’s Book, "Start with Strategy" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-384 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

5d ago

Money Printing 2.0? The Fed’s New Emergency Measure

The biggest announcement of last week’s Fed meeting had nothing to do with rate cuts . Instead, a quiet, mostly overlooked statement from the Federal Reserve could mean huge things for the economy, mortgage rates , and most importantly, the housing market. The mainstream seems to have missed it, focusing on the obvious news, but we’re breaking down the Fed’s new emergency tactic to stabilize the economy . What many thought would be a standard 0.25% rate-cut meeting was anything but. A fractured Fed , now split on rate cuts more than in prior years, has adopted a new tactic . Could this strategy be a return to a dangerous past—the days of “quantitative easing” (AKA money printing )? Or, does the Fed know what it’s doing, taking a more cautious approach than last time? We’ll break down the entire Fed story and share some crucial updates on housing inventory and affordability . Some markets are entering 2026 strong, with significantly lower inventory than pre-pandemic levels. Others could correct (or even crash) harder. Dave gives his opinion on which are which, sharing the markets that will thrive and the ones where home prices could dive . In This Episode We Cover The Fed’s new emergency measure designed to stabilize the economy and interest rates Money printing 2.0: Are we on a path back to dangerous quantitative easing? New rate cut forecast for 2026 and 2027 directly from the Fed The riskiest (and seemingly safest) real estate markets going into 2026 The most affordable city in the U.S ., and why it could thrive next year And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders A New Fed Chairman is Coming Soon—Here’s What Their Potential Low-Rate Policy Will Mean For Investors Dave's BiggerPockets Profile Grab Dave’s Book, "Real Estate by the Numbers" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-383 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Dec 16

The Return of “Easy” Real Estate Deals? 2026 Could Get Even Better

This might be the easiest time to find real estate deals in years —and early signs suggest 2026 could be even better . The year is almost over, so today, we’re reviewing our favorite trends, tactics, and real estate investing strategies of 2025 . Plus, many of them will last well into 2026. These are the things that we’re focusing on next year, and there’s a lot of good news for investors . This is shaping up to be one of the easiest times in years to find profitable real estate deals. But we’re not just talking rentals—we share a “mailbox money” investment that’s still holding strong in 2025 (and could in 2026). Plus, Dave details a “slow” strategy that builds wealth with way less stress—one that both he and James are going all-in on. Tired of sharing your profits with the tax man? A massive tax benefit that returned this year will last into 2026 , and Kathy is ready to take full advantage of it. In This Episode We Cover Why 2026 could be one of the easiest times to find real estate deals in years Dave’s “slow” investing strategy is making (patient) investors rich into 2026 Don’t buy rentals! Be the bank instead with this strategy ( sizable passive income ) Best tax break ever? It’s back, and it’s here to stay through 2026 Good news for first-time homebuyers, investors, and the entire country! And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area BiggerPockets Real Estate 1172 - How to Do a “Slow BRRRR” in 2025 (Better Than BRRRR) Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Grab Henry’s Book, "Real Estate Deal Maker" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-382 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Dec 11

Demand Springs Back for Winter Deals, But First-Time Homebuyers Vanish

We’re only a week away from winter, but the housing market is heating back up . Demand is rising as savvy buyers know that lower prices peak during the holiday season. But one crucial cohort is nowhere to be found…and it could have damaging consequences for the housing market as a whole. We’re back with another headline episode, taking the biggest stories from the housing market and giving our takes so you can make the best investing decision possible. This winter is feeling warmer for housing as demand does what no one expects —increases during the seasonally slow period of the year. What’s causing it— lower rates, FOMO , or something else entirely? Remember when people in their 20s used to buy houses? Well…not anymore. The new first-time homebuyer age reached a worrying new high , one that many of us couldn’t even believe. DSCR loan defaults are starting to tick up , doubling from this time last year. Is this a bigger deal than many think, and could it bring discounted investment properties to the table? Finally, Dave shares a sneak peek at BiggerPockets’ newest investor survey , where investors share what they think is coming in 2026…and there’s a lot to be excited about. In This Episode We Cover The new median age of America’s first-time homebuyers (borderline alarming) Why housing demand is going up during the (traditionally) slowest time of the year Delinquencies rising for DSCR loans ? Why investors are defaulting twice as much as last year A year of optimism : surprising finds from BiggerPockets’ newest investor sentiment survey The #1 best strategy investors are betting on for 2026 And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders BiggerPockets Real Estate 1210 - 2026 Home Price Predictions: The Correction Continues? Articles from Today’s Episode: Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Grab the Book "Real Estate by the Numbers" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-381 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Dec 9

Redfin: The Great “Reset” Starts in 2026

Redfin just called it. The housing market will “reset” in 2026 …or at least it’ll be the start of it. Chen Zhao , head of economics research and a returning guest on the show, has 11 predictions she and her team have formulated for the 2026 housing market . A long, slow period of progress could be upon us, as buyers get what they’ve been asking for : better affordability , a more normal market, and the chance to own where there’s work. But what does this really mean? Will mortgage rates fall? Will home prices drop? We’re going through each of the 11 predictions with Chen, discussing prices, rates, rents, refinances, transaction volume, and even how AI could become the “matchmaker” for Americans looking for their first or next property. Make no mistake, this is good news for many, and could be just the start of a cycle that finally puts average Americans in the position to purchase a home. But, for real estate investors and landlords , there could be another big benefit coming in 2026, one that has a direct impact on your cash flow . In This Episode We Cover Redfin’s 2026 housing market predictions (prices, mortgage rates, and more!) The great “reset” that is coming for the housing market (it’s already begun) Rent growth returns? Struggling landlords could get some relief next year The best and worst real estate markets that Redfin is forecasting for 2026 The AI effect on real estate and why more buyers are using bots to find homes And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area Redfin’s 2026 Predictions: Welcome to The Great Housing Reset Dave's BiggerPockets Profile Grab Dave’s Book, "Real Estate by the Numbers" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-380 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Dec 4

The “K-Shaped” Economy: Why the Middle Class Is Getting Crushed

Stock prices are up, home prices are high, gold , silver , and bitcoin have all had major bull runs. But the average American is broke. This is the “K-shaped” economy. If you feel like it’s harder to get by and the barrier to entry to invest is rising, you’re not going crazy. We’re in a new economy—a “K-shaped” economy —where those who own assets see their net worth soar as the middle class and average Americans watch their bank accounts shrink. This is not the place Americans want to be in right now, and the delicate balance that holds up our entire economy could fall apart sooner than we think. Dave explains what a K-shaped economy is, how it could bleed into the housing market , and whether this feast-or-famine system can survive much longer. Plus, he’ll share a shocking statistic that shows just how hard things are for ordinary Americans , and how a tiny minority is holding up the entire economy . In This Episode We Cover A “K-shaped” economy explained , and why Americans feel broke as asset prices soar A shocking statistic that shows just how unstable the American economy is Housing market side effects and the surprising age of America’s first-time homebuyer The widening wealth gap making investing harder for everyday people The three things that are keeping the middle class struggling (and why it’s gotten worse) Tough times ahead? Why America’s economy may be riding on billionaires and bubbles And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area On The Market 372 - New Recession Indicator Shows Americans Worse Off Than We Thought Dave's BiggerPockets Profile Redfin Reports U.S. Luxury Home Prices Jump 5.5% in October, Triple the Pace of Non-Luxury Homes Grab the Book, "Recession-Proof Real Estate Investing" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-379 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Dec 2

The “Delisting” Wave Putting Years of Housing Market Gains at Risk

Years of housing market gains could be at risk , and it’s not because of mortgage rates, the Fed, or the US government…it’s because of sellers . Since 2022, we’ve seen housing inventory rise, home prices stabilize (and fall in many major markets), and affordability slightly improve for buyers (thanks to higher supply and lower demand). But now, a new wave of “delistings” could put the future of the housing market in jeopardy. Sellers are refusing to settle , and they’re walking away at the fastest pace in eight years. So, what’s next? A housing crash? A continued correction ? If the delistings continue, one scenario could come to fruition, and it’s not what buyers want to hear. Dave walks through the new delistings data in this episode and shares some startling statistics on just how bad things are for young Americans . If the next generation can’t buy or rent a home…what happens to the economy? In This Episode We Cover The “delisting” wave hitting an eight-year high and putting years of affordability gains at risk Correction or crash? Why sellers are far less desperate than most people think Markets with the most delistings and where inventory could start to reverse first Cracks in the US economy and the trouble that young Americans are in Lower rent growth for longer? What happens when college graduates CAN’T get a job (or rent an apartment/house)? And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area On the Market 372 - New Recession Indicator Shows Americans Worse Off Than We Thought Dave's BiggerPockets Profile Grab Dave’s Book, “Real Estate by the Numbers” Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-378 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 27

The “Great Stall” Has Begun

The housing market is not going to crash tomorrow. It’s also not going to boom soon. We’re not in 2008, and we’re also not in 2020. We’re in a strange gray area, a zone that most Americans have never experienced before. We’re entering the “Great Stall.” And this could last for years. All data points to a new kind of housing market forming. But why, and why now? Is there any chance of a housing crash or home price explosion like before? Yes, but Dave is going to break down the odds of each scenario, plus what to do in the most likely scenario , while home prices stagnate and mortgage rates stay relatively high. If you want to take advantage of the “Great Stall,” so that when home prices do go back up you’ll profit, there are four things you need to do. We’ll break down each step so you can prepare and pounce on the investment property that makes your future self wealthy. The “Great Stall” is here, and when it’s over, millions of Americans will wish they had bought. In This Episode We Cover Crash, boom, or plateau? The most likely scenario for home prices over the next few years How to prepare for the “Great Stall” and take advantage of frozen home prices The “upsides” you must look for that could explode your wealth when appreciation returns Why you need to start going “ risk-off ” in your investing to protect your wealth What will finally cause home prices to rebound and Americans to get back into the market And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area On The Market 365 - This Housing Correction Could Last Years Dave's BiggerPockets Profile Build Your Investing Strategy BEFORE You Buy with "Start with Strategy" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-377 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 25

This Could "Break" the Housing System as We Know It

This could break the mortgage system as we know it. But, is it worth it? New “portable mortgages” have been floated by the Trump Administration and FHFA (Federal Housing Finance Agency), allowing homeowners to take their rock-bottom mortgage rates with them when they purchase a new home . The question is: will it work? We’re breaking down the likelihood of portable mortgages, how they currently work in countries like Canada , and the pros and cons for the average American. Most people are thinking about the upsides of a portable mortgage, but the downsides are equally severe. Would this really make sense in America? Dave is doing a deep dive into how the U.S. mortgage system works and whether new portable mortgages could break it, leading to the downfall of arguably the greatest home loan on the planet— the 30-year fixed-rate mortgage . Plus, how much more could it cost you to take out one of these portable loans? In This Episode We Cover Portable mortgages explained and how they actually work in countries like Canada How portable mortgages could “break” the fragile home loan system in the U.S. Pros and cons of portable mortgages that could help or hurt many Americans Increased fees , mortgage rates , and prepayment penalties ? Why nobody is talking about the side effects of portable mortgages Does Dave think this is a good idea? (strong opinion warning) And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders On the Market 373 - Trump Floats 50-Year Mortgages: Cash Flow Boost or Affordability Illusion? Dave's BiggerPockets Profile Grab Dave’s Book, " Real Estate by the Numbers" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-376 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 20

Keep Your 3% Rate Forever? “Portable” Mortgages Could Be Coming

What if you could transfer your 3% mortgage rate to a new property ? It could be possible in the near future. A new type of home loan would allow borrowers to move their mortgage rate when they sell and buy a new property, effectively ending the “ lock-in effect ” plaguing the housing market. Could a loan like this really come to fruition? We’re back on another headline episode , touching on real estate’s top stories that you need to hear to invest better than the masses. First, we’re talking about “portable mortgages,” another push for affordability from the Trump administration. You may be able to transfer your low rate…but for how long? Then, we touch on the real reason the housing market is stuck in purgatory, and the only way we’ll bounce back. Is this the fall of house flipping ? James goes public (front-page news!) with a six-figure loss and shares the truth about how hard it is to flip houses right now. Finally, we answer the question every 13-28-year-old is asking: Is Gen Z screwed? With a tanking job market, there’s only one way for them to survive… In This Episode We Cover New “portable” mortgage potential that could let you take your rate to a new home The fall of house flipping? Why even James is struggling to make a profit A shocking statistic about the average homeowner (why the housing market is stuck) No more trust funds: why “home inheritance” is becoming the new normal Gen Z can’t find jobs : here’s what they should be doing instead And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders On the Market 373 - Trump Floats 50-Year Mortgages Headlines from Today’s Show: Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Learn Flipping from the Pros with James’ Book, "The House Flipping Framework" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-375 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 18

Flat Home Prices “Mirror” 1990s: Small Multifamily Bound for Major Upswing

Another year is nearly in the books. The 2025 housing market was largely defined by construction oversupply , sluggish rent growth , flat home prices , and widespread turbulence , with residential real estate moving far more slowly than anticipated and commercial real estate all but grinding to a halt. Yet it appears we’ve reached the bottom, and the silver lining is clear : real estate is still ripe with opportunity for investors who are willing to play the long game . Today, Brian Burke returns to the show to share where investors should be directing their attention in 2026 . Perhaps unsurprisingly, one asset class continues to deliver for investors who are intent on building long-term wealth with real estate . And Brian believes we may be entering a period that could mirror the early 1990s , where the wisest move is to slowly accumulate these assets before the next wave of appreciation . Slower rent growth might keep otherwise great assets from paying off in year one, but those who persevere through a “season of patience” stand to be rewarded when it really counts: 5 or 10 years from now. In This Episode We Cover Forecasting new construction , home prices , and mortgage rates in 2026 Why a period mirroring the early 1990s could be followed by a 2000s-style boom The roadmap for building generational wealth with small multifamily properties Why investors should focus on asset accumulation in a “season of patience” The asset Brian believes is the biggest “bright spot” in a tough housing market The benefits and potential dangers of the controversial 50-year mortgage And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders 3 Steps to Buying Your First (or Next) Small Multifamily Property Dave's BiggerPockets Profile Brian's BiggerPockets Profile Pick Up " The Multifamily Millionaire, Vol I" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-374 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 13

Trump Floats 50-Year Mortgages: Cash Flow Boost or Affordability Illusion?

50-year mortgages could be coming sooner than we expected. This week, President Trump announced on social media the possibility of longer mortgage terms hitting the housing market. Extending the standard 30-year fixed-rate mortgage to 50 years will have massive implications for home prices , affordability , and cash flow for rental property investors. The question is: Will it actually happen? And if it does, how would these new mortgage rules affect your returns on real estate ? We did the math, comparing a 30-year mortgage vs. a 50-year mortgage to see which gives you bigger (total) returns and builds your wealth faster . The cash flow differences are notable and could mark significant improvements for landlords, but one drawback could be so great that investors turn away from this new mortgage entirely. Dave gives the pros and cons , shares what housing market experts are concerned about, and answers the question: Would he use a 50-year mortgage if given the option? In This Episode We Cover Trump’s new 50-year mortgage proposal that could change the housing market 30-year vs. 50-year mortgage returns on rental properties (cash flow, amortization , total returns) Why one outspoken housing expert is growing concerned about the support for 50-year mortgages One massive tradeoff that most Americans aren’t aware of when using a longer mortgage period Is a 50-year mortgage even…legal? What the current mortgage regulations say is and isn’t allowed And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders Amortization in Real Estate: What It Is & How To Calculate It Dave's BiggerPockets Profile Run Your Rental Numbers with Dave’s Book, "Real Estate by the Numbers" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-373 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 11

New Recession Indicator Shows Americans Worse Off Than We Thought

The United States is on the brink of a recession , according to major multinational bank UBS . Meanwhile, America’s largest bank, JPMorgan Chase, says recession risk is only at 40% . Who’s right? Who’s wrong? We’re using a new recession indicator in this episode to reveal America’s real risk of sliding into another downturn. If it feels like your dollar doesn’t go as far as it used to and your salary is barely keeping up—you’re not imagining it. But according to official sources , America has only been in a recession for three months since the Great Financial Crisis . That can’t be right when it’s getting this hard to get by. That’s why, in this episode, Dave shares his new recession indicator, based on the average American’s finances , to measure the financial health of real Americans, not what corporate earnings reports suggest. Looking back, the economic data doesn’t fit the official narrative. And if you feel like you’ve been in a recession for years , you might be right. But you can still protect (and grow) your wealth while the economy falters. Are your investments keeping your real wealth afloat? In This Episode We Cover The new “recession indicator” that forecasts whether average Americans will struggle or not Recession predictions from top banks and whether we’re on the precipice of a crisis Why the standard definition of a “recession” is wrong and ignores average Americans The alarming statistic that shows just how much of your spending power has been eaten away How to recession-proof your finances and invest so you can weather economic storms And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area BiggerPockets Real Estate 1119 - How to Invest in Real Estate During a Recession (2025 Update) Dave's BiggerPockets Profile Major bank issues warning that there’s a 93% chance of a recession in the US this year JPMorgan Chase: The probability of a recession has fallen to 40% Buy the Book, "Recession-Proof Real Estate Investing" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-372 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 6

Housing Demand Grows as 10 Major Cities See Price Drops

The housing market is seeing a (surprisingly) positive trend . Yes, even with all those YouTube channels showing you “empty” houses, it seems that homebuyers , especially millennials, are getting back into the game . This is excellent news for agents , lenders, title companies, sellers, and flippers. So, what’s the “positive” trend we’re seeing? We’re back with another headline episode to get you up to date on the housing market in just around half an hour. First, new data points to housing demand increasing as mortgage rates stay away from their 7%+ highs. Is there a path to 5% interest rates in the near future? Yes, but the road to it won’t be pretty. Here’s what would have to happen for us to get there. Can you guess the top 10 cities with the largest price drops in the US? We’re sharing the complete list in this episode, with some surprising cities near the top. Finally, we’ll discuss the massive layoffs from tech , including Amazon’s recent firing of over 10,000 well-paid employees. If you live in an area where these layoffs are happening, the market could see a noticeable shift . In This Episode We Cover Why housing demand is actually going up while economic optimism is going down A 5% interest rate future? What actually has to happen for us to get there The top 10 United States cities seeing the most significant price drops Why James is preparing for layoffs ASAP and tweaking his investing strategy as jobs get cut Money printing…again? The dangerous door that’s opening for quantitative easing And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Grab Dave’s Book, "Start with Strategy" Sign Up for the On the Market Newsletter Find Investor-Friendly Lenders BiggerPockets Real Estate 1191 - Home Prices Could “Stall” for Years Articles from Today's Show: HousingWire: Housing demand now reflects a positive trend ResiClub: Bank of America: Path to 5% mortgage rates if 'the Fed does MBS quantitative easing' Yahoo Finance: When will housing prices drop? Costs have already decreased in some major metro areas. Yahoo Finance: Layoffs hit Amazon, UPS, Target, and more — what's fueling the cuts Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-371 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Nov 4

Why Mortgage Rates are Rising as the Fed Keeps Cutting

The Fed cuts rates , and mortgage rates go up. Then they do it again, and rates…go back up. How does this keep happening? Has the Fed lost complete control over mortgage rates ? The Fed has now cut rates twice in 2025, and we’re hovering around the same (if not slightly higher) mortgage rates as before the first cut. After last week’s rate cut announcement , investors were surprised to see that mortgages—once again—got even more expensive . But it’s not because of what the Fed did—it was because of what they said, potentially foreshadowing a slower, longer path back to 5% mortgage rates . Dave is on to explain why mortgage rates moved in the opposite direction , why we could be stuck with higher mortgage rates for longer, and the two things that need to happen for mortgage rates to break back into the 5% range. Plus, he’ll share three realistic scenarios that could cause rates to move in different directions and what could trigger each. In This Episode We Cover The Fed meeting announcement explained and why mortgage rates went up The real reason why we’re not seeing mortgage rates fall below 6% Alarming corporate layoffs and whether this is a warning sign for the entire economy Some good/bad news about inflation and the cities that are faring the worst Three likely mortgage rate scenarios that could send rates in different directions, without the Fed making moves And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Grab Dave’s Book, Real Estate by the Numbers Sign Up for the On the Market Newsletter Find an Investor-Friendly Agent in Your Area BiggerPockets Real Estate 1194 - Don’t Bet on the Fed: What Investors Need to Do Now as Rates Rise Again Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-370 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 30

New Zillow Forecast: Best and Worst Housing Markets of 2026

The national housing correction is here but your results will be decided locally. Some markets are cooling gently, others are slipping fast, and a few affordable metros are still running warm. So where does that leave buy-and-hold, flips, STRs, and BRRRRs? We map the dramatic regional split, Midwest/Northeast steadier, Gulf Coast/Texas under pressure, and show how to match your strategy to on-the-ground realities like inventory, rent growth, and affordability. You’ll hear why “flat prices + rising rents” can be a green light for cash flow, when to take a calculated swing in oversold-but-strong-fundamentals cities (think Austin/Nashville/Dallas), and where supply and insurance costs are pushing deeper discounts (hello, Florida). We also dig into metro-level forecasts into 2026 and why your underwriting should look different in Milwaukee than in Miami. In This Episode We Cover Local > national: why the same correction looks totally different by region and price tier Affordability & supply: the two signals driving winners and laggards (and how to measure both) Hottest vs. coolest markets: where buyers have leverage and where demand still pops Rents vs. prices: pairing flat/declining prices with rising rents to improve cash flow Risk-on vs. risk-off playbooks: conservative buy boxes vs. opportunistic dips in strong cities Flipping in a slowdown: wider spreads, longer days-on-market, how to price and pace Forecasts into 2026: what recent metro projections imply for your next 3 - 12 months of deals Hold or sell? Handling “paper losses,” market selection, and underwriting for a slower cycle Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-369 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 28

Smart Money is Going After New Homes as Builder Desperation Grows

Discover how a new era of real estate investing could benefit you! In this episode, Doug Brien, CEO of Roofstock, joins the discussion to uncover the evolving dynamics in the housing market. Learn why new construction, once considered a riskier bet, is now an exciting opportunity due to adjusted interest rates and surplus supply. Doug dives deep into the intricacies of institutional single-family home investing, sharing insights on why market fundamentals—like housing demand and supply shortages—make single-family rentals a savvy choice. Curious about where savvy investors are putting their capital? Tune in to discover how you can leverage these market shifts to enhance your real estate strategy. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-368 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 23

What We’re Buying During This Real Estate Correction

Are you ready to navigate this real estate market correction? While some experts argue whether we're in a crash or a correction, our hosts explore practical strategies to adapt and thrive. Discover how you can make profitable decisions during these times of stagnant or slightly declining housing prices. With insights from real estate pros Kathy Fettke and Henry Washington, learn how they are adjusting their investing strategies to cope with changing interest rates and housing prices. Whether you're recalibrating expectations or exploring opportunities in less conventional markets, this episode offers valuable perspectives to help you ride out the correction and capitalize on long-term wealth building. Tune in to equip yourself with frameworks that withstand the test of fluctuating mortgage and interest rates! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Henry's BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-367 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 21

Homebuyer Cancellations Spike, New Price Forecast Shows Slow 2026

Feeling anxious about the housing market? You're not alone. Recent data show that U.S. cancellation rates for property deals have reached a record high this year, with buyers taking advantage of more moderate conditions to re-evaluate their options. With a projected 10-year increase in housing prices by about 23.5%, experts suggest we may finally be heading towards a more stable market environment, where traditional investment strategies like securing great assets at fair prices could truly shine. Curious about how real estate fraud could impact investors as the market evolves? We’ll also explore rising cases of fraud and the steps you can take to protect yourself. Dive into this episode as we unravel the complexities of short-term housing trends and long-term predictions, while maintaining a proactive approach to safeguarding your investments. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-366 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 16

This Housing Correction Could Last Years

The headlines say “slowdown,” but let’s call it what it is: a housing correction. Prices (in real terms) are slipping, days-on-market is stretching, and cooling is broadening across regions and price tiers. What does that actually mean for buyers, sellers, and investors and how is a correction different from a crash? We unpack the data, define the terms, and show you how to play offense without taking on unnecessary risk. We break down nominal vs. real prices (and why inflation math matters), why widespread cooling doesn’t equal panic, and the key forces restoring affordability: rates, wages, and prices. Plus, how long a typical correction lasts, why “forced selling” is the real crash trigger (and why we’re not there), and what to do if your on-paper values dip. Finally, we get tactical: tightening your buy box, underwriting with flat rents and conservative appreciation, negotiating in a slower market, and deciding when to hold vs. sell, so you’re positioned for the next expansion, not paralyzed by the current stall. In This Episode We Cover Correction vs. crash: clear definitions, real-world thresholds, and why speed + depth matter Nominal vs. real prices: how inflation turns “up 2%” into a true decline The cooling map: regions and price tiers that are slipping and which are merely slowing Why inventory is rising (but not flooding) and why low delinquencies keep this a correction How long corrections typically last and what could shorten or extend this one Playbook for 2025–26: precise buy boxes, conservative underwriting, better negotiations, and handling “paper losses” without panicking Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-365 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 14

Housing Market Loses Steam, “National Buyer’s Market” Likely in 2026

The market is sending mixed signals, so what does that mean for buyers and sellers right now? Prices are cooling toward neutral, new listings are finally creeping up, pending sales just slipped, and days on market are the longest since 2019. We sort through the latest data so you can read your local market with clear eyes. A government shutdown is already touching housing. With the National Flood Insurance Program paused, some coastal and riverine deals are stalling as buyers struggle to bind coverage. We explain one potential workaround by assigning an existing policy, plus how many closings could be delayed if the lapse drags on. Zooming out, we track fresh signs of consumer strain. Subprime auto delinquencies are at a record, average car payments now top 750 dollars a month, and sentiment has split sharply between households with big stock portfolios and those without. Several states are flirting with recession risk, which could tug mortgage rates lower, while sticky inflation could keep them pinned. In This Episode We Cover Cooling home prices, rising days on market, and what a near-flat Case-Shiller trend means for offers and list strategy The shutdown’s housing ripple effects, including the flood insurance lapse and an assignment tactic that may keep deals alive Why pending sales dipped even as new listings rose, and how to negotiate in a thinner buyer pool Auto loan stress, four-figure car payments, and what these budget pressures mean for future housing demand A tale of two consumers, plus a state-by-state look at recession risk and how that feeds into mortgage rates Action steps for buyers, sellers, and investors in a market that is cooling, not crashing Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-364 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 9

Housing Market Update: The Crash Bros are Wrong (Again!)

We can definitively say it now: the buyer’s market is here. The housing market is cooling down , but the deals are heating up as a “mild” correction slows down hot markets and gives buyers even more power in cold ones. With it comes buying opportunities —ones that real estate investors have been starved of over the past few years. You can negotiate for more, offer less, and lock in a lower mortgage rate than last year. The question is: will this correction turn into a full-blown housing crash ? Dave’s giving you his honest (and data-backed) opinion in this September 2025 housing market update ! Mortgage delinquencies are rising rapidly in one subset of the market, the crash-bro clickbaiters say it’s a sign of a coming housing apocalypse—are they finally right about something? One thing is certain: a few housing markets across the US are in danger of slipping into an even more oversupplied market. But, with new data showing that sellers are quitting and walking away , will this reverse the worrying trend? Stick around, we’ve got your housing market update without the hype. In This Episode We Cover The “mild” housing market correction : what it means and whether it’ll become a crash Updated home price predictions and how much prices will rise/fall by the end of the year Signs that you can start confidently bidding under asking price (but by how much?) Why inventory is beginning to reverse (have sellers finally had enough?) Mortgage delinquencies are rising : who’s affected and could it lead to foreclosures ? What investors should do now to prepare to buy discounted deals (be patient!) And So Much More! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Sign Up for the BiggerPockets Real Estate Newsletter Find an Investor-Friendly Agent in Your Area Dave's BiggerPockets Profile BiggerPockets Real Estate 118 - Data Says It’s a Buyer’s Market: Here’s Where the Most Opportunity Is Grab Dave’s Book, "Start with Strategy" Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-363 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 7

New Tariffs Aimed Directly at Real Estate Investors (Who They’ll Affect)

What are the repercussions of October 1st on the housing market? Dive into the recent shifts that may impact real estate investing and the broader housing market landscape. With the imposition of new tariffs on construction materials, stirring concerns about rising costs, alongside a federal government shutdown complicating the economic outlook, how will these factors play out in the current market scene? Explore the nuances of how these events intersect with flood insurance policy lapses and the phasing out of COVID-era FHA loan modifications. Each of these elements could influence mortgage rates and housing affordability, shaping investor strategies moving forward. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Henry's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-362 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Oct 2

One of the Best Types of Rentals Just Got Cheaper

Is the new construction market the golden ticket for real estate investors in 2025? With newly built homes now cheaper than existing ones, thanks to regional pricing differences, builders' incentives, and a desire to move inventory quickly, this could be an unexpected opportunity for savvy investors. In this episode, Dave Meyer explores why new construction is suddenly appealing, how mortgage rates and home prices are shaping this trend, and what investors need to consider when diving into this market. Are you ready to explore the potential in this unique turn of events in the housing market? Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-361 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 30

This Small Group is Driving the Entire Economy (and They’re About to Stop)

Is a recession really coming, or is this the new normal for the housing market? Dave Meyer and J Scott unpack how post-2008 shifts, record debt and money printing, tariffs, and AI are changing the rules, then connect inflation and the labor market to mortgage rates and interest rates so you can gauge what moves them next. You will get a risk-off playbook for today’s deals, including conservative underwriting, assuming flatter rents and higher vacancy, buying at today’s rates, and favoring fixed-rate debt, plus why single-family housing prices are usually resilient outside of severe shocks. Their housing market prediction and forecast: expect mostly stable home prices with modest moves while mortgage rates hover near current levels, with bigger swings only if jobs crack hard or inflation reaccelerates. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-360 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 25

Rates Reverse: Why More Fed Cuts WON’T Get Us Below 6%

Fed cut rates for the first time in nine months, yet mortgage rates climbed again, so Dave breaks down why and what happens next for the housing market. He explains that the Fed funds rate mainly moves short-term interest rates, while long-term lending tracks the 10-year Treasury and risk spreads, with inflation risk keeping mortgage rates stubborn. His housing market prediction and forecast: expect mortgage rates to hover in the low to mid sixes through 2025, meaning tight affordability and mostly stable home prices, while commercial real estate could benefit more due to shorter-term debt structures. Takeaways for investors include underwriting deals at today’s rates, tracking inflation and labor data, and preparing for steady transaction gains rather than a rapid drop in interest rates or a surge in housing prices. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-359 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 23

Fed Cuts Rates, Mortgage Applications Jump 30% Overnight

Fed rate drop, refinance rush, and a land price reset: what does it mean for the housing market now. Henry Washington, Kathy, and James explain why refinance applications jumped roughly 30 percent after 30-year mortgage rates slipped near 6.39 percent, how today’s ARMs actually work, and why locking a refi now can beat waiting for future interest rates to fall. They outline a practical housing market prediction and forecast, expecting more transactions rather than a surge in home prices or housing prices, plus timing tips for listing into the spring when buyer activity historically rises. You will also get a reality check on the “great wealth transfer” and reverse mortgages, along with a land strategy playbook for a potential price decline, from targeting big-lot houses and infill splits to using seller financing to create equity and cash flow. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-358 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 18

Rising Unemployment Could Spill Into Real Estate (But By How Much?)

Is the labor market finally cracking, and what does that mean for the housing market? Dave Meyer distills the latest BLS and ADP payrolls, JOLTS, and unemployment data, from August’s 22,000 nonfarm payroll gain and a 4.3% jobless rate to a 900,000 downward revision and a spike in initial claims, to show a clear cooling trend. He explains why a softer labor market raises the odds of Fed cuts yet inflation keeps pressure on interest rates, so mortgage rates may ease only modestly, boosting transaction volume more than home prices or housing prices. You will hear practical plays for real estate investors, including watching local job numbers, prioritizing tenant retention and collections, and considering refinances if you hold 7 to 8 percent loans, plus how markets like Las Vegas and San Francisco may diverge. Dave’s housing market prediction and forecast: a soft but functioning market with cautious upside, where housing prices stabilize and conservative underwriting wins until clearer trends emerge. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-357 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 16

New Mortgage Monitor Report: Sellers “Pull Back,” Will Rate Cuts Change That?

Is this a housing market correction or a crash? Dave Meyer and ICE’s Andy Walden unpack the Mortgage Monitor: nominal home prices are up about 1.1% year over year, but real housing prices are negative; sellers are stepping back, inventory gains are cooling, and demand still tracks mortgage rates and interest rates, which points to a soft but functioning housing market. You’ll hear the regional story in Denver, Florida, and Texas, why FHA delinquencies are inching up while 2020 to 2021 loans perform well, and how soaring property insurance is squeezing affordability and debt to income ratios. Plus, a housing market prediction/forecast: if mortgage rates land in the low sixes (around 6.25% by year end), expect firmer home prices rather than a COVID era surge. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-356 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 11

The $84T “Wealth Transfer” Coming for the Housing Market

Will the housing market surge for the next 25 years, or is the silver tsunami overblown? In this episode, the hosts of "On The Market" delve into the potential impacts of an $84 trillion wealth transfer on the real estate landscape. As millennials stand to inherit significant sums, will this money flow into real estate, and could it shake up the housing market? As they explore these trends, they also weigh in on the ongoing debate: will aging boomers lead to a market crash or a boom? Tune in to find out how interest rates, mortgage rates, and housing prices may evolve in the coming years. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-355 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 9

Ray Dalio Issues Blunt Warning for Real Estate

Are current market conditions making real estate a risky investment? This episode of "On the Market" with Dave Meyer dives into the recent warnings from the investment icon Ray Dalio, who advises against real estate investments due to factors like interest rate sensitivity, ease of taxation, and illiquidity. Meyer explores the potential implications for real estate investors and unpacks Dalio's unique perspective on the national debt and long-term debt cycles. How might these economic factors shape the housing market and mortgage rates in the coming months, and should real estate still be considered a stable asset amidst uncertainty? Discover the nuances of hedging risks and positioning your portfolio to weather potential economic storms. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-354 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 4

Investors Are Controlling the Housing Market (Not How You Think)

Are you worried that real estate investors are skewing the housing market? In this episode of On the Market, host Dave Meyer and guest expert Rick Sharga dive into the complexities behind investor activities in the housing realm. Discover how investor behavior has shaped the current market landscape, influencing housing prices and inventory. Contrary to some beliefs, small investors play a critical role by fueling market liquidity rather than causing housing prices to spike. Listen in as they unravel how mortgage rates, housing market forecasts, and affordability trends will unfold over the next couple of years. As we tread through this transitional period, the housing market could remain lukewarm for a while longer. Are we on the verge of a 'great stall' or just a balanced market correction? Tune in to find out! Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-353 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Sep 1

Investor Who Timed Market (3 Times!) Says Now May Be Bottom

The housing market is already predicted to see price cuts by the end of the year, but is now the time to buy, or should you wait for further price movement? We brought on an investor who has successfully timed the housing market (three times) to give his thoughts on whether we’re at the bottom or we have a long way to go. If you’ve been holding out for lower home prices and less competition, should you take the risk and wait , knowing a rebound could be on the way? Through a combination of genius and a bit of luck, Brian Burke has sold, bought, and sold at the right times repeatedly. He exited the majority of his real estate portfolio in the early 2020s as prices hit all-time highs and competition was fierce. For the last three and a half years, he hadn’t bought anything, up until very recently. Is this a signal that now is the time to buy? Today, we’re asking Brian whether 2025 is the right time to buy (and for which assets), how to get in “position” to make a profit as home prices decline, the sellers most likely to give you concessions and further price cuts , and signs YOU should sell your headache rental and trade it for something better. The second half of 2025 could be when the scales tip —are you ready to make a move? Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Grab Brian’s Book, “The Hands-Off Investor" Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile BiggerPockets Real Estate 1100 - The Ultimate Underrated Rental Property of 2025 (for Small Investors) w/Brian Burke Brian's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-352 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 28

Why 62% of Americans Never Break into Millionaire Status w/Nick Maggiulli

Is the “long fizzle” the housing market’s next chapter? With mortgage rates still high and interest rates keeping cash parked in T-bills, many buyers are sidelined, pointing to a housing market prediction of flat home prices in nominal terms and falling housing prices after inflation. Dave and analyst Nick Maggiulli connect today’s risk-on/risk-off behavior back to housing and outline three paths: melt-up followed by a correction, a long fizzle, or a supply-driven drop that’s least likely. Nick also shares a practical playbook so you can position for any housing market forecast, focus on income growth, keep investing steadily, and aim for “doubles” in real estate while protecting your downside. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-351 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 25

Property Taxes Banned? States Imagine a Tax-Free Future

Are property taxes actually illegal theft from homeowners? This episode dives deep into the growing chorus of Americans claiming property taxes violate constitutional property rights, examining two main legal arguments: the "no true ownership" theory, and possible Fifth Amendment violations. These arguments are gaining steam in several states, but are they legally valid? On The Market host Dave Meyer explores that question, plus how rising home prices are driving property tax reform movements across states like Florida, Ohio, and Pennsylvania, potentially reshaping the housing market by reducing ownership costs and affecting home prices, mortgage affordability, and regional migration patterns. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-350 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 21

4 Trends That Are Making Real Estate Investors Rich in 2025

Are real estate investors finally finding cash flow opportunities again after years of struggle? In this episode of On the Market, expert investors Dave Meyer, Kathy Fettke, James Dainard, and Henry Washington reveal four game-changing housing market trends they're seeing right now. These include new construction beating fix-and-flip returns and off-market deals becoming more common as inventory stacks up. Discover why cash flow is actually returning to stabilized rental properties and how smart investors are navigating today's shifting mortgage rates, housing prices, and market conditions to build profitable portfolios. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-349 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 18

Do “Cash Flow Markets” Really Make You Rich?

Is chasing hot markets like Austin and Nashville actually hurting your long-term wealth building? In this episode, Dave Meyer and Kathy Fettke dive deep into a heated BiggerPockets forums debate about whether low-appreciation, high-cashflow markets like Cleveland and Memphis can grow your net worth faster than trendy appreciation markets. They reveal why the "slow and steady" approach might not be the wealth-building winner you think it is, sharing real examples from Kathy's 30 years of investing across both market types. Dave and Kathy discuss the hidden costs of cashflow markets, why timing matters more than market type, and how to find the perfect hybrid markets that offer both appreciation potential and solid returns in today's challenging housing market conditions. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-348 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 14

Buy More, Wait, or Reinvest Cash Flow? (2025 Buyer’s Market)

With housing market conditions shifting dramatically from a seller's to buyer's market, real estate investors are facing a critical decision: should you buy more properties now, pay down existing mortgages, or wait for even better deals? In this episode, On The Market host Dave Meyer and expert panelists Kathy Fettke, James Dainard, and Henry Washington dive deep into current market opportunities, sharing specific examples of deals that weren't available just months ago and debating whether declining home prices and falling mortgage rates create the perfect storm for investors. Dave, Kathy, James and Henry reveal their contrasting strategies on leverage versus debt paydown, explore how interest rates impact investment decisions, and discusse why timing the housing market perfectly might be less important than having a clear investment plan with target returns. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Henry's BiggerPockets Profile James' BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-347 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 12

On the Market Podcast: The smartest way to stay ahead in real estate

Hosted by Dave Meyer, On the Market breaks down the most important economic, housing, and investing news, so you can make smarter, data-driven decisions. Whether you're an intermediate investor, an industry professional, or just a data nerd, this show helps you: Decode market shifts and investing trends Understand how the economy impacts your portfolio Hear directly from top experts and analysts Make confident, strategic investing moves If you're ready to go beyond beginner content and truly understand the "why" behind the headlines, On the Market is your next essential listen. Subscribe and get the edge real investors rely on. Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 11

Price Cuts Hit 12-Year High, Sellers Reconsider Quickly

Are we witnessing the beginning of a housing market crash, or is this just a healthy correction? With 42% of homes on the market having taken price reductions — the highest level in 12 years — host Dave Meyer sits down with Mike Simonsen, Chief Economist at Compass, to decode what these dramatic inventory changes really mean for investors and homebuyers. This episode reveals why rising inventory and falling prices don't automatically signal a market crash, and how current market dynamics are creating unprecedented buyer negotiating power for the first time in years. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-346 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 7

Trump Wants 1% Rates: What Will Happen If He Gets Them

Could President Trump's battle with Jerome Powell and the Federal Reserve over interest rates actually lead to higher mortgage rates instead of the lower rates Trump is pushing for? On The Market host Dave Meyer explores how Trump's challenge to Fed independence might backfire (hint: bond investors don't like it) and the economy-wide implications for uncertain rates in the near future. This is a must-know topic for anyone accounting for future mortgage rates in their current investing strategy. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-345 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Aug 4

Major Forecasters Revise Price Predictions, “More Softening to Come”

Why are home prices finally falling? And how deep will the correction go? The number of large housing markets experiencing falling home prices has tripled since January 2025. ResiClub editor-in-chief Lance Lambert joins On The Market host Dave Meyer to break down why this widespread softening is happening now, how price dynamics are pushing more buyers toward new construction, and whether we've reached the bottom of the softening cycle. Lance also shares data on underwater mortgages and delinquency rates to forecast whether signs point toward a cyclical correction or a catastrophic crash. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-344 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Jul 31

Multifamily Buying Window Widens (We’re Already Investing)

Dave Meyer and Kathy Fettke reveal their current real estate investment strategies, including the assets and markets they think will have the best values for the rest of 2025. Dave and Kathy emphasize the importance of securing fixed-rate financing in today's volatile interest rate environment, warning that commercial loans may be risky with uncertainty around the future of Fed independence and the rising national debt. Later in the episode, Dave explains why hard assets like real estate remain excellent hedges against potential currency devaluation, and how properties can turn inflationary environments into advantages for investors. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Kathy's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-343 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Jul 28

Buyer Cancellations Hit All-Time High (Perfect Buying Signal?)

Successfully navigating today's housing market requires understanding the trends creating both opportunities and risks for investors. But what if varying data points in different directions? While the national average home price hit a new record high, prices in more than one third of major U.S. housing markets are now declining, particularly in Florida and Texas where some areas face crash-level drops. Meanwhile, new construction starts are slowing as builder confidence erodes and contract cancellations have reached 15%, signaling a shift toward buyer leverage. Host Dave Meyer breaks down what these mixed housing market signals mean for real estate investors on this episode of On The Market. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-342 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Jul 24

2025 Mid-Year Mortgage Rate Predictions (Update)

Will mortgage rates finally fall in the second half of 2025? Host Dave Meyer predicted rates in the mid-6's back in December, which has proved accurate halfway through this year. Now, Dave is providing his outlook for the rest of 2025, and a long-term mortgage rate forecast for the next several years. Meyer discusses the structural forces that could drive the mortgage landscape and the housing market for the next decade, including inflation rates, recession fears and ever-increasing national debt. This is crucial data for real estate investors to understand, especially those that have previously utilized a "date the rate" strategy. Links from the Show Join the Future of Real Estate Investing with Fundrise Join BiggerPockets for FREE Find an Investor-Friendly Agent in Your Area Find Investor-Friendly Lenders Property Manager Finder Dave's BiggerPockets Profile Check out more resources from this show on BiggerPockets.com and https://www.biggerpockets.com/blog/on-the-market-341 Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email advertise@biggerpockets.com . Learn more about your ad choices. Visit megaphone.fm/adchoices

Jul 21

What Happens to Real Estate When the Dollar Declines?